Pocket Option Live Strategy: Mastering the Art of Trading

The realm of online trading is both exciting and daunting, particularly for newcomers. One of the platforms that has gained significant popularity is Pocket Option, known for its user-friendly interface and a variety of asset options. In this article, we will delve into the pocket option live strategy pocket option live strategy that can help you navigate the complexities of trading in real time.

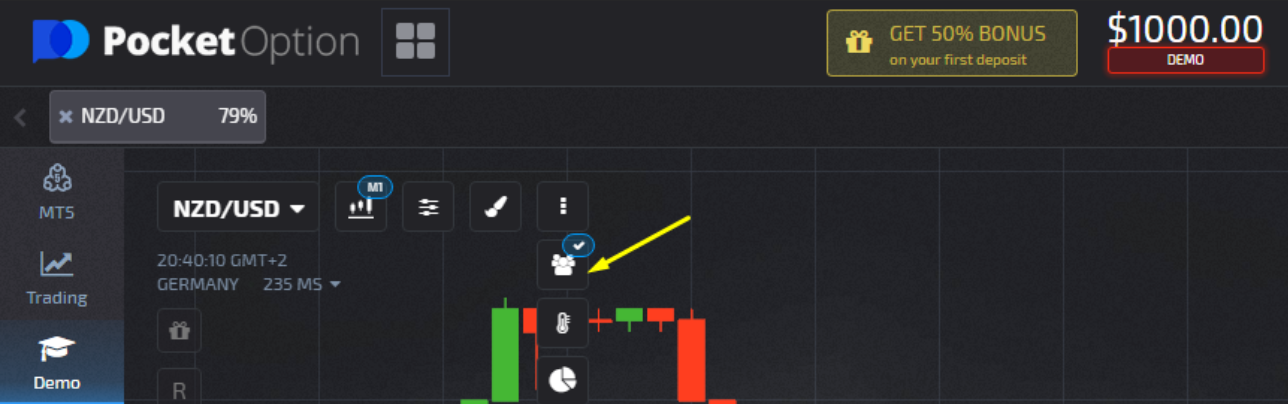

Understanding Pocket Option

Pocket Option is a binary options trading platform that allows traders to speculate on various assets, including currencies, commodities, stocks, and cryptocurrencies. Launched in 2017, the platform has attracted a large user base due to its innovative features and high return potential on trades. With options to start trading with as little as $1 and the ability to earn up to 95% on trades, it offers a unique opportunity for those looking to get into trading.

Getting Started with Pocket Option

- Register an Account: Begin by creating an account on Pocket Option’s website. The process is straightforward and requires minimal personal information.

- Fund Your Account: Once your account is set up, deposit funds using the various payment methods available such as credit cards, e-wallets, or cryptocurrencies.

- Choose Your Asset: Select an asset you are interested in trading. Carefully analyze trends and market movements to make educated decisions.

- Practice with a Demo Account: Before diving into live trading, take advantage of the demo account feature. This allows you to practice without financial risk.

Key Strategies for Live Trading

To effectively trade on Pocket Option, it’s essential to develop strategies that work for you. Here are several methods to consider:

1. Trend Following

Analyzing financial charts is paramount in spotting trends. The trend-following strategy involves identifying the overall direction in which the market is moving—upwards, downwards, or sideways. Traders aim to enter the market at the beginning of a trend and capitalize on it until signs of reversal occur.

2. News Trading

Market news can significantly affect asset prices. Being aware of upcoming economic reports or political events can help traders anticipate changes in the market. The news trading strategy involves making trades based on market reactions to news releases and headlines.

3. Support and Resistance Levels

Support and resistance are key concepts in technical analysis. Support is the price level at which an asset tends to stop falling and may bounce back up, while resistance is the level at which it tends to stop rising. Understanding these levels can aid traders in making decisions about when to enter or exit trades.

4. Risk Management

No trading strategy is complete without a solid risk management plan. Set a maximum loss percentage for each trade and stick to it. Consider employing stop-loss orders to automate the process of limiting your losses.

Using Indicators to Enhance Strategy

Indicators can provide additional insights into market trends and help traders make informed decisions. Some useful indicators on Pocket Option include:

- Moving Averages: These smooth out price data to create a trend-following indicator and help identify the direction of the trend.

- Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements to evaluate overbought or oversold conditions.

- Bollinger Bands: These are volatility indicators that show how far the price has moved from its average. They are useful in identifying potential buy and sell signals.

The Psychology of Trading

Trading is not just about numbers; it’s also about the trader’s psychology. Emotional responses to winning or losing can cloud judgment. Maintaining a disciplined mindset is crucial. Here are some tips to improve your trading psychology:

- Stay Objective: Base your decisions on analysis rather than emotions.

- Keep a Trading Journal: Document your trades, emotions, and the reasons behind your decisions. This can help identify patterns in your behavior.

- Accept Losses: Understand that losses are part of trading. Learn from them and move on rather than trying to recover losses immediately.

Continuously Educate Yourself

Market conditions change constantly, and ongoing education is essential. Engage in webinars, read books, and join trading communities online. Continuous learning and adapting to market changes can keep your trading strategies effective.

Conclusion

Mastering the pocket option live strategy involves a combination of technical analysis, effective risk management, and psychological discipline. By implementing the strategies outlined in this article, you can enhance your trading skills and aim for consistent profitability. Remember that every trader has a unique journey, and success takes time and dedication. Happy trading!

Recent Comments